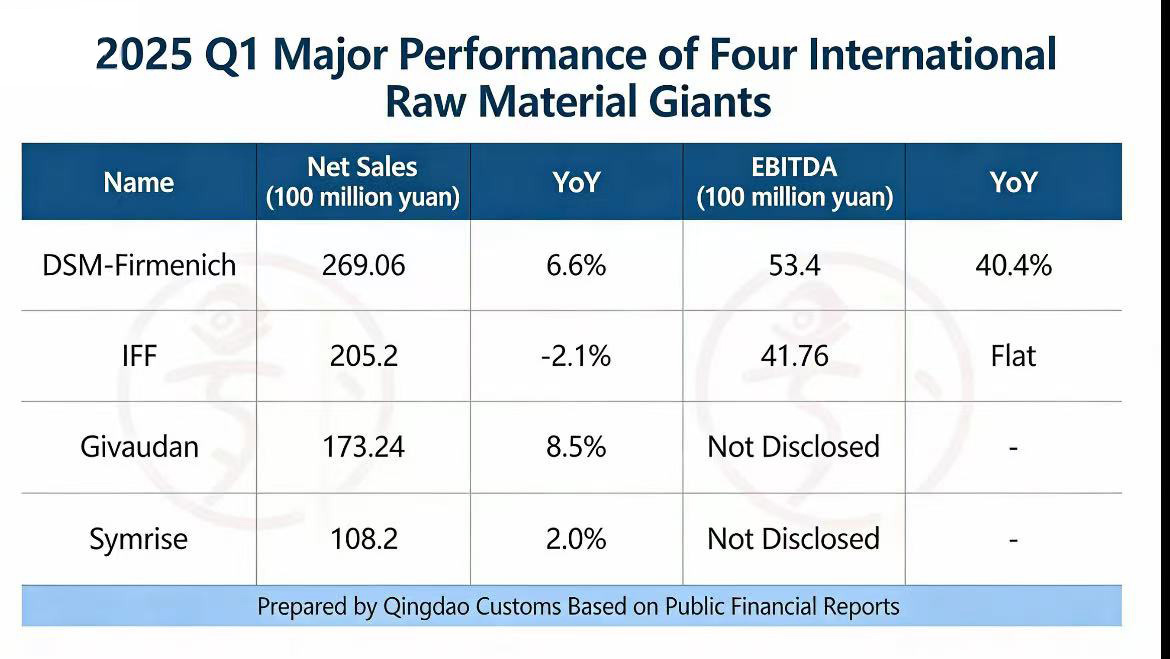

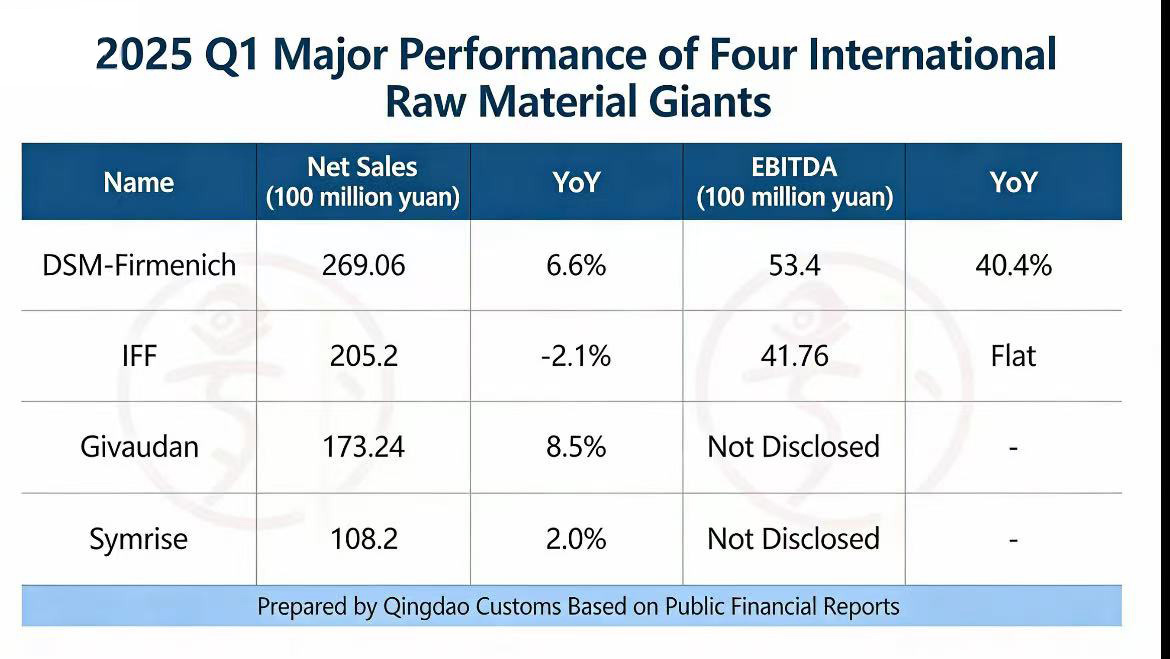

Some time ago, Blue Eyes released a set of data. After reading it, it really made people feel that the class of the raw material circle is strict.In the first quarter of 2025, the total sales of the four major flavor giants, Symrise, Givaudan, Firmenich and IFF, totaled 75.57 billion yuan. The volume is still quite scary, but when you take it apart, each family's life is different.

Firmenich is the boss of Proper, with sales of 26.906 billion yuan in the first quarter, an increase of 7% year-on-year, especially EBITDA directly soared by 40.4% to 5.34 billion yuan. With this eye-catching result, the high-end perfume business is definitely the number one hero.On the other hand, IFF's record is a bit miserable, with sales of 20.52 billion yuan, down 2.1% year-on-year, and a loss of 7.18 billion yuan before tax.What is even more worrying is that IFF's sales have grown weakly in the first quarter for three consecutive years. The 21.683 billion yuan in the same period in 2023 has become the peak in the past three years, and then it will not be as good as one year.Foreign media said that this is mainly because IFF has been engaged in the restructuring of the nutrition department and business divestiture, resulting in goodwill impairment.However, the CEO of IFF also said that the divestiture of the pharmaceutical business was completed two months in advance in the first quarter. This is a milestone and can help the company reduce its debt leverage ratio.

Just when IFF was pulling his crotch, Givaudan quietly realized a counterattack.For the whole year of 2024, Givaudan led the Big Four with a sales growth rate of 7.2%. In the first quarter of 2025, it was even stronger, with net sales of 17.324 billion yuan, an increase of 8.5% year-on-year, once again becoming the fastest growing among the Big Four.The CEO of Givaudan is also very happy, saying that although the base is high in the same period last year and there is uncertainty about global tariffs, the start of each business, customer and region is particularly good, and we will continue to focus on innovation and help customers grow together.

Symrise reported sales of 10.82 billion yuan in the first quarter, an increase of 2% year-on-year. Although it was a positive increase, the trend of slowing growth was particularly obvious.Remember that in the first quarter of 2023, Symrise will be able to achieve double-digit growth, leaving only 2% in the first quarter of this year.However, the CEO of Symrise is quite optimistic, saying that although the macro economy is not very good, the company has achieved profitable growth. Next, it will rely on the “ONE Symrise” strategy, continuous innovation and business collaboration to increase profits. It is also expected to achieve organic growth of 5% to 7% in 2025.

Why is the performance differentiation of the Big Four so obvious?In fact, just look at the market demand.In the past two years, the perfume market has simply opened up. According to Euromonitor's data, the global perfume and fragrance market size in 2024 will be between 405.5 billion yuan and 434 billion yuan, and it is expected to exceed 564.183 billion yuan by 2027, with a compound annual growth rate of 10%.With such a large market in front of them, the four major fragrance giants will naturally compete, and the high-end perfume business has directly become their main task for soaring performance.

If you want to say the most eye-catching performance, it has to be Givaudan.In the first quarter of this year, the net sales of its perfume and beauty business directly rushed to 8.776 billion yuan, an increase of 12.2% year-on-year.Especially in the high-end perfume sector, the increase has soared to 16%, which is the main growth force of the department.Firmenich's perfume and beauty division also did not suffer, with sales of 8.298 billion yuan, an increase of 3% year-on-year. Among them, the high-end perfume business also ran out of double-digit good results.Symrise's fragrance care department has taken a steady route, steadily capturing 4.29 billion yuan in sales.Even IFF, whose overall performance is not very prosperous, made a special mention during the earnings call-its high-end perfume business has not only achieved double-digit growth, but its order volume is also steadily increasing.

However, if there is a hot business, there are sectors that are dragging their feet.In stark contrast to the popularity of high-end perfumes, the beauty business, especially the sunscreen raw materials, has become a burden on the big Four.Givaudan's fragrance raw materials and active beauty business, sales rose by only 7.7% in the first quarter, the lowest growth rate among all businesses in the perfume and beauty division.Firmenich's perfume and beauty sectors also handed over beautiful answers, with sales of 8.298 billion yuan in the first quarter, an increase of 3% year-on-year. Its high-end perfume line achieved double-digit growth in one fell swoop, becoming a key force driving performance.Symrise's fragrance care business is steadily developing, relying on a solid market reputation, it has steadily recorded 4.29 billion yuan.Even IFF, whose overall performance is under pressure, specifically emphasized at the earnings communication meeting that its high-end perfume business has not only achieved double-digit growth, but its order volume is also steadily climbing.

But the market has always been a few happy and a few sad. If there are businesses that are shining, there are sectors that are dragging their feet.Compared with the singing of high-end perfumes, the beauty care business, especially the sunscreen raw material business, has become a common “small annoyance” of the big four.Givaudan's fragrance raw materials and active beauty business, sales rose by only 7.7% in the first quarter, the lowest growth rate among all business lines in the perfume and beauty division.Firmenich's perfume and beauty division had a harder time. EBITDA directly fell by 2% year-on-year. After all, the sales of beauty care products fell off the chain.Symrise's sales of cosmetic raw materials business also failed to reach the level of the same period last year. The company itself admitted that the core reason was that sunscreen was sold too hot in the first quarter of last year, and the base was raised too high. Compared with this year, the growth is weak.

Firmenich's management also gave a special explanation on this matter: From 2023 to the first half of 2024, after the epidemic control was liberalized, the global tourism market suddenly caught fire, and consumer demand for sunscreen increased explosively. Downstream brands and distributors also took the opportunity to stock up in large quantities, which directly caused the sales of sunscreen products in the first quarter of 2024 to reach a historical peak.As a result, in the second half of 2024, consumer demand slowly returned to rationality, and the market became saturated. The order volume of sunscreen raw materials in the first quarter of this year naturally fell.They also predict that the trend of declining sales of sunscreen products will most likely continue into the second quarter, which may slightly drag down organic growth in the first half of the year, but in the second half of the year, as market demand picks up, this situation should gradually improve.Symrise also said that with its own differentiated product lines such as micro-protection technology, natural plant ingredients, and new sunscreen filters, the cosmetic raw material business will definitely be able to keep up with or even beat the average market growth rate in the future.

In addition to the uneven heat and cold of market demand, the uncertainty of tariff policies has added to the already difficult raw material market.In the short term, price increases have become the unanimous choice of international raw material giants.Symrise said in the earnings report that if necessary, it will discuss with customers to adjust prices to offset the pressure of rising costs.Firmenich is more direct, and has passed on the tax cost to customers since April.Givaudan also made it clear that because raw materials, energy and tariffs have all risen, he will work with customers to promote price increases.Although IFF did not mention a price increase in this earnings report, it has already risen for a round before, and the profit in the first quarter exceeded analysts' expectations, relying on the previous price increase measures.

International giants have increased prices one after another, which is both a challenge and an opportunity for our domestic raw material companies.After all, in such an industry, only by sticking to the original intention can we go further.

Compared with international giants, our biggest advantage is our own factory.A perfect localized production system can not only ensure stable product supply, but also effectively avoid additional costs such as tariff fluctuations and international logistics.In terms of product research and development, we have always kept up with the market trend, whether it is theEmulsifier for cosmetics commonly used in skin care products, which can make water and oil better blend and make the product more comfortable to use, or

Isododecane, which is inseparable from makeup, which has good volatility and strong spreadability, which can create a refreshing and non-greasy makeup effect, or the

Cationic Softener in care products, which can make hair and clothes soft and smooth. We can all produce these popular raw materials, and the quality can stand the test.

More importantly, we have always adhered to the promise of “price-friendly”.International giants have increased prices one after another because of rising costs, but we rely on the advantages of localized production and do not have to bear so many additional costs. No matter how difficult the market environment is, we will not blindly follow the trend and increase prices.On the contrary, we will digest the cost pressure by optimizing the production process and improving production efficiency, and give more benefits to customers.After all, in the cosmetic raw material industry, quality and reputation are the foundation, and stable prices and reliable supply are the key to long-term cooperation with customers.In the future, we will continue to increase investment in R&D and develop more high-quality raw material products to meet the diverse needs of our customers.

The market for cosmetic raw materials has never been calm, and the tide of price increases is just an episode in the development of the industry.But we always believe that as long as we stick to our original intention and rely on the hard power of the factory and the price of the people, we will definitely be able to gain a foothold in this big wave of sand, go up against the current, and step out of our own development path.